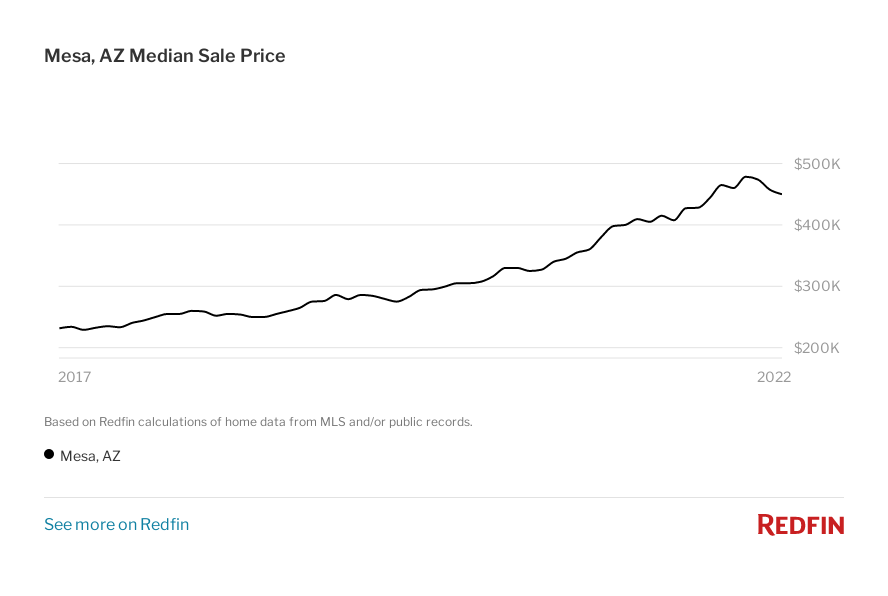

Home sales are a part of the economy that is affected fast and significantly when the Federal Reserve raises interest rates. Buyers are directly and immediately impacted but sellers are also seeing the fallout. Beginning in March, we have now had five interest rate increases with three of them being three-quarter-point hikes. Interest rates have not risen this fast and this high since the 1980s. Rising mortgage rates are continuing to slow housing market demand, resulting in slowing sales and less home price appreciation.

Over the last six months, mortgage rates started at about 3%, jumped to 3.5%, then leaped to over 4%, then up to 5%, and now appear to be firmly above 6.25%. Each rate increase means more buyers are coping with steeper monthly payments and sellers are experiencing less demand for their homes with pressure mounting on sellers to reduce prices to make houses more affordable for buyers. And more rate hikes are likely to come as the Fed gave warnings of serious economic hardship ahead at its September meeting. The bottom line is that unaffordable housing prices, a bear stock market, hot inflation, and the war in Europe are weighing on almost everyone with an interest in the economy.

From a Home Buyer’s Perspective

For buyers, higher interest rates weaken their competitive bargaining power because higher monthly mortgage payments prevent them from bidding on houses that they would have qualified for several months ago. Today, instead of looking at houses close to what they have been dreaming of while saving the down payment, they are forced into purchasing a home in a lower price range due to qualifying for a lower loan amount. The major factors affecting preapproval are the size of the down payment and the buyer’s debt-to-income ratio. When a buyer’s monthly payment will be higher due to a high interest rate, they have to go with a lower loan amount which means a less costly house. This is forcing people down into lower cost houses which have been and remain in low supply.

For buyers, it is going to get worse at the lower end of the market. In a more balanced market, sellers would typically not rise the asking price when interest rates rise. Sellers would likely even lower the price if offers were not coming in. However, in the current market, inventory is low, and buyers may remain priced out of the market. Also, to be considered during inflationary times with rising interest rates is more pressure on regular household budgets. Not only is everything in the stores costing more, but interest payments on existing debt are going up.

From a Home Seller’s Perspective

The few sellers that are in the market have developed an attitude that prices will continue to rise based on recent history. They still believe they will receive multiple offers, often at or above the asking price. Sellers are only accepting offers from preapproved buyers and will want to continue doing that. What might be changing is for sellers to check that the preapproval is based on current interest rates. Sellers might also want buyers to lock in their preapproved interest rate as soon as possible since more rate hikes are in the future. Sellers also need to prepare themselves for the fact there are going to be fewer preapproved buyers in the market. Fewer offers are going to come in and it’s going to take longer to sell a house. The times when a house sold within a week or two after being listed are probably behind us.