Home buying has changed significantly over the last 10 years due to several economic, social, and technological factors. Some of the major changes are: Increased use of online resources: With the advent of online real estate listings, virtual tours, and digital signing, the home buying process has become more streamlined and accessible to buyers.Gr...

Staging a house showing is an important part of the home selling process, as it can help make the property more attractive to potential buyers. Here are some tips on how to stage a house showing: Declutter and depersonalize: Remove any personal items, such as family photos and personal memorabilia, as well as excess clutter. This will help buyers v...

There are many different types of house styles, each with its own unique features and characteristics. Here are some of the most common house styles: Colonial: This style originated in the 1600s and features a symmetrical facade, typically with a central entrance, evenly spaced windows, and a gable roof.Victorian: This style originated in the mid-1...

REALTOR

Caroline and her pup Buddha moved from Orlando to Denver in 2019, bringing only what could fit inside her rear-wheel drive Chevy Camaro. It didn’t take long before she bought a Toyota Tacoma, joined CorePower and started sporting an REI water bottle. When she’s not snowboarding, she’s either house hunting for clients, staging homes or both.

Prior to becoming a realtor, Caroline was traveling the world as a full-time painter making a home out of hundreds of unique places including Moroccan riads, Nepali tea houses, Laotian teepees and that one 4×4 converted camper truck around Africa. Her almost 4-year-long nomadic journey certainly opened her eyes to what makes a space feel like home and her real estate career is the perfect culmination of her travels. After all, working in real estate grants her the ability to help her clients find their ultimate home base! She also owns a home staging and interior design business called Dune Home Interiors allowing her expertise to extend even beyond the house buying & selling process.

For all things home, Caroline is on your timeline and excited to work with you.

My Listings

Start of list of properties

All information subject to change and should be independently verified. See Disclaimer

Copyright © 2003 - 2023 Buying Buddy. All rights reserved.

Copyright

© NewERAGroup

See what’s happening around town!

February 1st – 28th: Black History Month

“Each February, Black History Month honors the achievements and contributions of African Americans to the country. Here’s how you can celebrate throughout the Denver metro area with lectures, dramatic performances, music and more, both before and after Black History Month!” Schedule & More Info!

Copyright

© NewERAGroup

A Slow Start, but Higher Consumer Confidence

In our local real estate market, the start to the first quarter of 2023 felt a lot like the fourth quarter of 2022; somewhat slow. With an official recession likely this fall, high inflation, and the mortgage rate hikes of last year, it’s understandable why many people have been apprehensive to make a move.

Despite the slow start, consumer confidence has been on a sharp rise recently. Consumer confidence is a great leading indicator of what will happen over the next few months. To try to anticipate what the market might do, the best metrics to pay attention to are consumer confidence, new mortgage applications, home showing activity, mortgage rate locks, and finally closings.

The spike in consumer confidence indicates people are a bit more optimistic about the economy than before. If they weren’t, they wouldn’t apply for new mortgages. The increase in mortgage applications should eventually flow through the rest of the metrics, resulting in more home sales. It’s a great sign for the spring, which is historically the busiest time of year in real estate.

Copyright

© NewERAGroup

Fun things going on this month!

Now – January 22nd: National Western Stock Show & Rodeo

“Bulls and broncs, cowboys and cowgirls – rodeo’s biggest superstars perform amazing feats of athleticism during each performance of this professional rodeo. Showcasing the elegance and athleticism of the world’s top reining horses, the hard-hitting competition of Denver Professional Bull Riders Chute-Out and the Mexican Rodeo Extravaganza, this event has something for everyone.” Tickets & More Info!

Copyright

© NewERAGroup

Year-End Reflections

2022 turned out to be a turbulent year for the economy. To start, the FED had announced that they would be rolling back their pandemic measures, in order to combat high inflation. What many did not expect was for Russia to invade Ukraine, which put pressure on world markets, including oil/gas and agriculture. Russia is a major exporter in both industries, especially in minerals used to make fertilizer. Ukraine produces high percentages of the world’s grain, iron, and steel, among other exports. Between interruptions to trade, political sanctions on Russia, and investor fears, this had a major effect on a world economy already reeling from the pandemic.

The conflict in Europe, among other factors, threw the U.S. economy into fresh turmoil. Stocks tumbled throughout the year. Although they bounced back from their lowest point in September, they are currently on track for their biggest losses since 2008. Inflation skyrocketed to rates not seen in the U.S. since the 1980s! This forced the FED to take an even more aggressive stance against inflation.

Copyright

© NewERAGroup

Fun December things to do!

Now – December 23rd: Denver Christkindlmarket

“Experience the warmth and charm of an authentic German Holiday Market right in the heart of Denver. Stroll through alleys lined with cozy wooden huts and shop for unique, finely crafted artisan gifts and tasty treats brought to you by local and international small businesses. As cheerful sounds of live holiday music fill the air, savor the season with traditional glühwein, German biers, and traditional holiday fare from across Europe. Every year, from November to December, guests of the Market are invited to explore the magic of Europe during the holidays – no passport required.” More Info!

Copyright

© NewERAGroup

Good News and Bad News

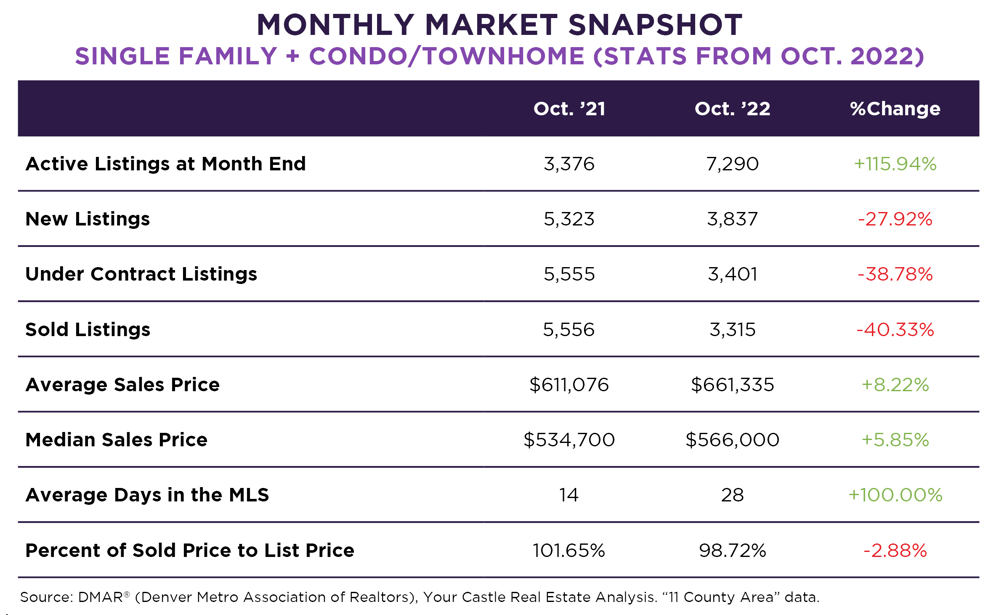

As usual, how things are going in the real estate market depends a lot on your point of view, and individual goals. One thing that stands out this year is that according to the Wall Street Journal, we’ve had the biggest yearly decline of mortgage applications on record. From a cutthroat spring to dramatic mortgage rate hikes, and the subsequent decline in real estate sales, it’s no wonder there’s been such a dip in activity over the course of the year. In October, metro Denver sales were down by 40% from October of last year! Although, it’s not all doom and gloom. In fact, at the same time this W.S.J. headline came out about the dramatic decline in mortgage applications, mortgage rates went down by half a percentage point in the same week. The reason? News came out that inflation may have finally hit its peak and seems to be on the decline now!

Copyright

© NewERAGroup

Check out these great November events!

November 11th – December 23rd: THE POLAR EXPRESS Train Ride

“Enjoy Holiday Magic, Caroling and the “Hot Chocolate’ song and dance performed in the heated Polar Express Pavilion. Ride to the North Pole aboard vintage coaches, pulled by an authentic, coal-fired steam locomotive. Visit with Santa and delight as he hands you “The First Gift of Christmas!” Always a sell-out, you’ll want to book early. Tickets begin at $80/person ages 2-15, $100/person ages 16 and older (Lap Riders under age 2 Free) with upgraded First Class ticket options for Tables of Four for $475 also available.” Tickets & More Info!

Copyright

© NewERAGroup

Inventory Levels Continue to Climb

The current real estate market in Denver and the surrounding counties is very similar to the one we saw in June, July, and August. In short, the number of houses for sale is up dramatically in recent months. At the end of September, the number of active listings was up almost 94% from last year. In the most recent tally, there were 7,683 homes for sale. Average home prices were up, at around an 8.5% increase. The days on market were also up. It is now taking an average of 26 days to sell a home, as opposed to 13 days last year. And finally, the number of sales was down again in September, at around a 30% decline from last year.

So, what does this all mean? To answer that, it’s important to have a historical perspective. It’s easy to feel like we’ve shifted into a buyer’s market with a 94% increase in inventory. Although the recent spike in inventory has made things a bit easier on the buy-side, it’s also critical to realize that this time last year featured the lowest housing inventory count in over thirty years. A 94% increase sounds dramatic but in reality, it was a big jump from next-to-nothing to still-not-enough. Inventory is still about half the historical average of 15,700 homes on the market in September. We are also well short of the 4-6 MOI (Months of Inventory) needed to move into a balanced market. In September, MOI was only about 30 days (1 month). Negotiations are getting a little easier for buyers this fall, but there is still big room for improvement when it comes to having enough for-sale housing in our market.

Copyright

© NewERAGroup

Check out these October events!

Now – October 29th: Corn Maze at Chatfield Farms

“Wind your way through seven acres of corn. The maze can be viewed from a 15-foot tall bridge. This year’s maze promises a Dinomite exploration of prehistoric time. Visitors under the age of 10 can explore the corn mini-maze.” Tickets & More Info!

Copyright

© NewERAGroup

From a Strong Sellers’ Market to a More Typical Sellers’ Market

One of the most notable things about our latest analysis of market data was that the number of new listings at the end of August has almost doubled from the same time last year – from 3,582 in August ’21, to 6,939 this past August (see stats below). Although inventory has been significantly on the rise, we are still shy of the inventory we would need to shift into a buyer’s market. It appears we seem to be moving toward a more balanced market and that we’re currently experiencing a more “typical” seller’s market.

Still, sellers seem reluctant to list right now because of uncertainty in the market. With rising rates, inflation at a forty-year high, a recession, the war in Ukraine, and the midterm elections coming up, who can blame them?! There are a lot of excuses not to sell if you need one. However, if you are a potential seller, keep in mind that prices are still up about 7% from this time last year. Not only are prices still up, but many homeowners are sitting on hundreds of thousands in equity thanks to the unprecedented home appreciation from the last few frenzied years of the extreme seller’s market.

If you do decide to sell, it’s important to remember that things have shifted. Homes selling for a premium is now the exception and no longer the norm. Just because your neighbors sold their house for tens of thousands of dollars above asking not too long ago in the spring, does not mean the same will happen to you. The average premium for homes is down about 3% from last year. Most homes are now selling near the asking price. Overpriced homes sit on the market longer, usually end up with major price cuts, and lose the upper hand in negotiations. It’s important to have an experienced agent who can create the best strategy to get your home sold for top dollar in this shifting market.

Copyright

© NewERAGroup

Home sales are a part of the economy that is affected fast and significantly when the Federal Reserve raises interest rates. Buyers are directly and immediately impacted but sellers are also seeing the fallout. Beginning in March, we have now had five interest rate increases with three of them being three-quarter-point hikes. Interest rates have not risen this fast and this high since the 1980s. Rising mortgage rates are continuing to slow housing market demand, resulting in slowing sales and less home price appreciation.

Over the last six months, mortgage rates started at about 3%, jumped to 3.5%, then leaped to over 4%, then up to 5%, and now appear to be firmly above 6.25%. Each rate increase means more buyers are coping with steeper monthly payments and sellers are experiencing less demand for their homes with pressure mounting on sellers to reduce prices to make houses more affordable for buyers. And more rate hikes are likely to come as the Fed gave warnings of serious economic hardship ahead at its September meeting. The bottom line is that unaffordable housing prices, a bear stock market, hot inflation, and the war in Europe are weighing on almost everyone with an interest in the economy.

From a Home Buyer’s Perspective

For buyers, higher interest rates weaken their competitive bargaining power because higher monthly mortgage payments prevent them from bidding on houses that they would have qualified for several months ago. Today, instead of looking at houses close to what they have been dreaming of while saving the down payment, they are forced into purchasing a home in a lower price range due to qualifying for a lower loan amount. The major factors affecting preapproval are the size of the down payment and the buyer’s debt-to-income ratio. When a buyer’s monthly payment will be higher due to a high interest rate, they have to go with a lower loan amount which means a less costly house. This is forcing people down into lower cost houses which have been and remain in low supply.

For buyers, it is going to get worse at the lower end of the market. In a more balanced market, sellers would typically not rise the asking price when interest rates rise. Sellers would likely even lower the price if offers were not coming in. However, in the current market, inventory is low, and buyers may remain priced out of the market. Also, to be considered during inflationary times with rising interest rates is more pressure on regular household budgets. Not only is everything in the stores costing more, but interest payments on existing debt are going up.

From a Home Seller’s Perspective

The few sellers that are in the market have developed an attitude that prices will continue to rise based on recent history. They still believe they will receive multiple offers, often at or above the asking price. Sellers are only accepting offers from preapproved buyers and will want to continue doing that. What might be changing is for sellers to check that the preapproval is based on current interest rates. Sellers might also want buyers to lock in their preapproved interest rate as soon as possible since more rate hikes are in the future. Sellers also need to prepare themselves for the fact there are going to be fewer preapproved buyers in the market. Fewer offers are going to come in and it’s going to take longer to sell a house. The times when a house sold within a week or two after being listed are probably behind us.

Copyright

© NewERAGroup

Owning real estate is a worthwhile investment, but what happens when available properties in your area are out of your budget? If you live in a place like San Francisco, you’re surrounded by some of the highest home prices in the country. Can you still own real estate as a way of investing? The answer is yes, but you have to think out of the box.

Rental PropertiesThe key is to buy real estate in places that are more affordable, yet still have growing populations and promising home values. Let’s take a look at the benefits and drawbacks of out-of-state investing, as well as some tips to help you do it successfully.

Why Invest in Out-of-State Properties?

If you live in an area with high real estate prices, you may want to invest in out-of-state properties. This allows you to get into the business of real estate at a price point you’re more comfortable with.

Here are other reasons for considering this method of real estate investing:

Diversification: The best way to mitigate risk is to diversify. If one market in your portfolio sees a downturn or crash, you will likely benefit from having properties in other regions.Tax benefits: Every state has different tax implications, and some are better than others. Owning property in a state with more allowable tax deductions or investor-friendly laws can help you achieve the best return on investment (ROI). Personal use: Perhaps you’re interested in eventually moving, or maybe you simply want a vacation home. Many people buy out-of-state rental properties in locations they enjoy to take advantage of favorable market conditions.Challenges to Consider When Investing Out-of-State

Like anything in real estate investing, there are challenges to buying out-of-state rental properties. Perhaps the biggest hurdle is the initial investment of time. It always pays off to spend a significant amount of time researching the area you’re considering.

Copyright

© NewERAGroup

Upgrading your home isn’t as simple as it might seem. Installing marble countertops or a big swimming pool in the backyard might seem like a no-brainer, but you’re just as likely to lose money as you are to boost your home value.

The reason is simple: You’ve got to upgrade to the market, not your personal tastes. Even if prospective buyers like the $20,000 wine cellar you added, they may not want to pay $20,000 extra when it comes time to negotiate the sale price. If they don’t, you’ve just lost a lot of money that you could have put toward home-selling expenses.

Whether you’re selling with a five-star agent or posting your for-sale-by-owner listing online, you’ll want to consider your home upgrades carefully. Here are the most common upgrades that don’t add value when selling your home.

1. Carpeting

Although new carpet was once considered a tried-and-true upgrade, wall-to-wall carpeting is no longer a popular feature for today’s buyers. Many buyers have concerns about allergens and contaminants in carpet, and they would prefer a simple wood floor. That should be good news because refinishing or installing a new wood floor usually costs less than new carpeting.

2. An Expanded Owner’s Suite

Combining a smaller bedroom and the owner’s suite to create a bigger space with a sitting area and walk-in closet can result in a very attractive and eye-catching home. The problem is that you’ll lose an entire bedroom. In general, the more bedrooms a home has, the more it sells for. That means whatever bump in value the deluxe owner’s suite provides will be canceled out by the decline in value from losing a bedroom.

Copyright

© NewERAGroup

You can sell a home that needs a new roof if you’re willing to make repairs. It actually happens more than you think. There are always sellers that know that their home needs a new roof, but they want to list and sell it “as-is”. But, there are a lot of things you need to consider before selling your home.

If you want to sell a house with a bad roof, there are some things you need to know.

There Are Two Ways To Sell Your House When You Have A Leaky Roof

If you’ve noticed that your ceiling has water stains, damaged siding, or deteriorating flashing around chimney flues and vents, you need to deal with the problem immediately. You might be able to fix the damage yourself by replacing some of the shingles or flashing, but if not, you could end up having to replace the whole roof.

You could sell your house without having to replace the entire structure. Instead, let the buyer replace the roof.You’ll first need to replace the roof yourself and then sell the house.We’ll go through the specifics of each method when it comes to selling your home. We’ll discuss what’s good and what isn’t so good about both options.

Copyright

© NewERAGroup

Summer, it’s been a blast. Though as the last of the BBQ’s sizzle out and the mornings get a little darker it’s time to get set up for the cozy season. This may mean making a few changes to our routines to ensure we stay healthy, especially when it comes to bedtime. As we transition into Autumn, many of us can experience disrupted sleep. The effects this has on your mood can be heightened as the clocks go back with SAD (seasonal affective disorder) affecting 1 in 3 people across the UK. If you struggle with sleep this time of year, grab yourself a pumpkin-spiced latte and enjoy a read of these top tips to stay rested all Autumn.

Light it upNot a fan of dark mornings and shorter evenings? You are not alone. This is one of the main reasons people do not look forward to Autumn, though with a few easy tweaks you can let the light in! Exposure to light in the morning is important to help regulate your circadian rhythm, whether this means opening the blinds in the morning or using a light therapy lamp. Lighting up your bedroom room in the morning helps signal to your pineal gland that it’s time to start the day. Getting as much natural light throughout the day as possible will also boost your mood and keep your internal body clock ticking down the hours till bed. Make it part of your Autumn routine to get your boots on and enjoy a leaf-crunching walk around the park, followed by a nice hot drink when you get home!

Find the perfect mattressIs there anything better than that last ten minutes in bed on a cold morning? Nope! As long as you have a great mattress. If there’s ever a time to invest in better bedtimes it’s Autumn, and your mattress is the first place to start. Sleep is personal, though we can all benefit from one that offers proper spinal support, optimum comfort, and motion control to prevent disturbances throughout the night. A Bamboo Hybrid Mattress ticks all the boxes, with a breathable BioCell Foam that regulates body temperature and a hypoallergenic bamboo cover to take care of skin. A thermo-regulating mattress will keep you sleeping comfortably for seasons to come. In the quest for great sleep this Autumn, it’s worth finding ‘the one that will make bedtime perfect.

Work it outIf you missed the gym this summer, now is a great time to make up for it. Keeping active throughout Autumn will help release dopamine and endorphins that will boost your mood and keep you energized. Low energy is typical in the darker months, though a daily workout whether a quick stroll or replacing an uber with a bike ride will make a big difference. Firstly, having a routine may help you stay more positive especially when it involves something that is great for your heart, mind, and joints! Secondly, exercise can give your immune system a boost. You are fending off pesky colds and sniffles. Get your trainers at the ready and get your sweat on for a glowing Autumn.

Fill up on the good stuffAutumn is full of things to be grateful for. From better fashion (hello knitted jumpers and warm socks) delicious food and cozy nights on the sofa. Netflix better has some goodies in store. Though most importantly it’s a time to spend with our loved ones and gives us an opportunity to slow down and take better care of ourselves. From filling up with nutritious, seasonal food, less work, more rest, and plenty of hot chocolates. Allow yourself to fill up on the good stuff this Autumn, and who knows… it might just become your favorite season!

Copyright

© NewERAGroup

One of the most significant roles of a real estate agent representing a home seller is to provide them with an accurate market value. Homeowners use the information provided by agents to make many financial decisions in their life.

The value received could even be an impetus to whether a home seller decides to move or not. Given the stakes are so high, it makes sense that there should be quite a bit of thought that goes into an accurate home value.

There are a few things that can easily throw off home values. Some of the most common ones include using price per square foot, providing the wrong comparable sales, and using Zillow for an estimate of value.

None of these methods will lead to the right results. Let’s take a look at what you need to know.

Using Price Per Square Foot

One of the easiest ways to come up with the market value of a property is using price per square foot. It is also one of the least reliable.

Copyright

© NewERAGroup