News that Compass has let go of Chief Technology Officer Joseph Sirosh did not make the company’s stock tumble. Not yet. CEO Robert Reffkin announced Sirosh’s departure at market close Thursday. The stock remained virtually unchanged ($3.25 NYSE: COMP) throughout Friday. However, it’s doubtful Reffkin, or any Compass investor slept much this weekend.

Back in June, we predicted that this market flip would put added focus on elite agents and brokers like Chicago’s Matt Laricy. The massive layoffs at Compass and Redfin earlier this year were a big warning buzzer. And now we seem to be watching as enormous investments tumble. The Real Deal story on Sirosh getting the axe doesn’t pull punches, but most of the rest of industry media uses terms like “belt-tightening” to describe what looks to me like a freefall.

In the past, Compass said that it spent $900 million to build out its technology platform. Now, the technology aspect seems questionable somehow. Compass competitors have suggested the quasi-tech firm is a residential brokerage in disguise. It looks like the detractors may have been correct, and if they were, many people invested almost a billion to build a broker recruitment hook.

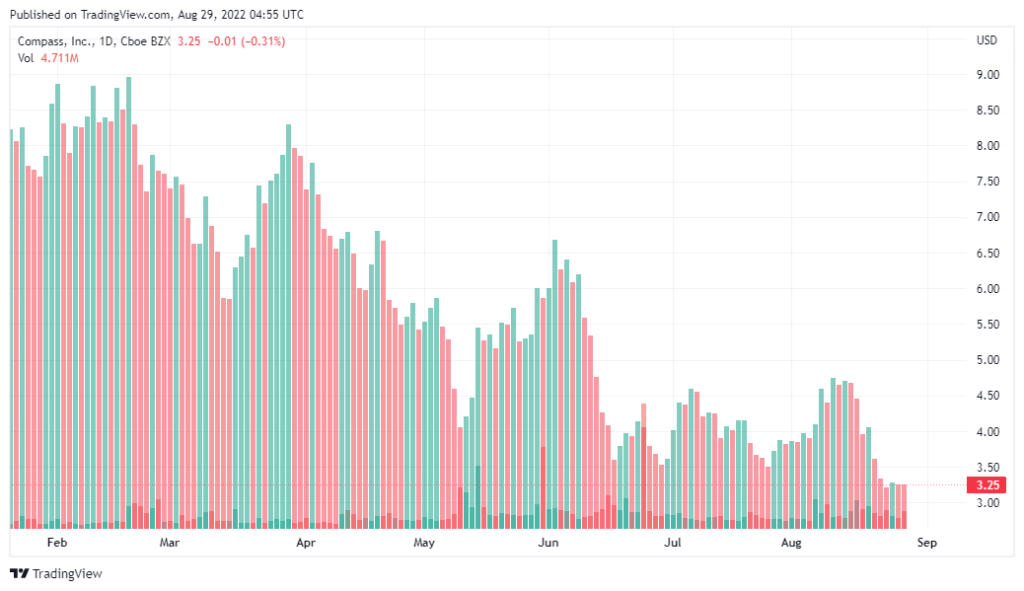

Compass stock has been in a kind of waffling freefall since the IPO

Compass stock has been in a kind of waffling freefall since the IPOSirosh was Compass’ CTO since late 2018 and brought viability to Compass’s claims of advanced tech. He formerly worked for almost six years for Microsoft in AI and at Amazon in similar roles. This was something Compass got a lot of mileage out of before going IPO. Then, within three months of going public, the company lost 30% of its initial opening value of $20.15 on April 1, 2021. Now it’s down over 83%. It would be interesting to see who cashed out over the past year among the horde of big investors who held billions in stock early on.

In the announcement, the Compass CEO could not resist telling Inman that his company’s 28,000 agent-entrepreneurs in a statement about “enhanced tools” and the tech platform. This is sad if you think about the high hopes pinned on the idea. Not so long ago, Compass was looking like the dominant player to come. And the company had already pirated hundreds of the top agents in the U.S. When the market heated up in 2019, Compass was selling more residential real estate than anyone.

At the end of the discussion, Compass has never really turned a profit. At least not a gain you’d expect from a multi-billion dollar real estate entity with this kind of reach. And if the company cannot clean and jerk the big bucks during a housing boom, what will happen when the going gets tough? The company has also announced a $320 million “cost-reduction program,” which I am sure will thrill the remaining investors. This week should tell.