Denver Real Estate News – December 2022

Good News and Bad News

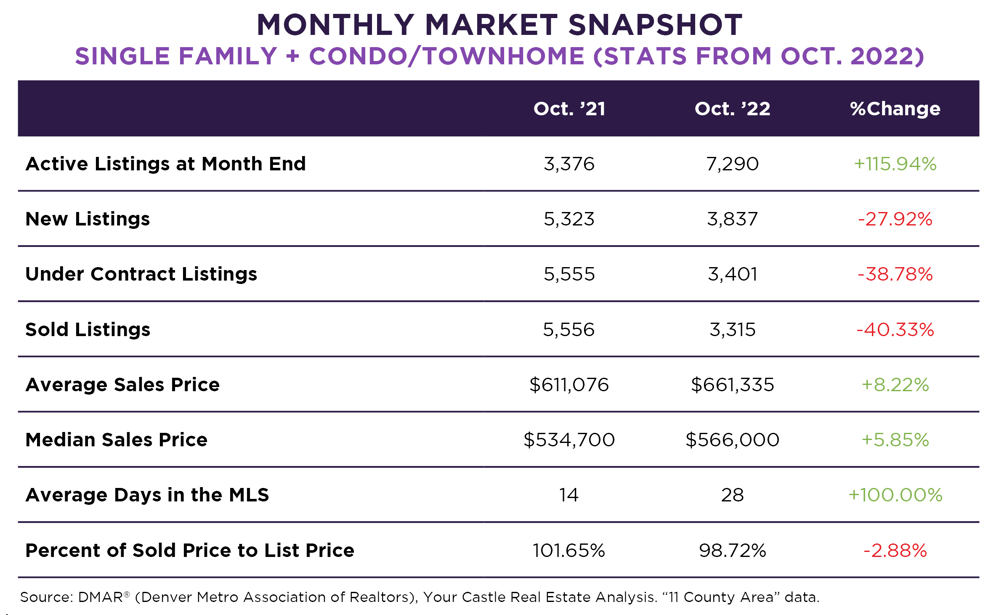

As usual, how things are going in the real estate market depends a lot on your point of view, and individual goals. One thing that stands out this year is that according to the Wall Street Journal, we’ve had the biggest yearly decline of mortgage applications on record. From a cutthroat spring to dramatic mortgage rate hikes, and the subsequent decline in real estate sales, it’s no wonder there’s been such a dip in activity over the course of the year. In October, metro Denver sales were down by 40% from October of last year! Although, it’s not all doom and gloom. In fact, at the same time this W.S.J. headline came out about the dramatic decline in mortgage applications, mortgage rates went down by half a percentage point in the same week. The reason? News came out that inflation may have finally hit its peak and seems to be on the decline now!

The factors that determine inflation are complicated, but you can see from this Consumer Price Index chart (below) that Gasoline, Energy, and Electricity prices recently went down considerably. As you can tell from the half-a-point reduction in mortgage interest rates mentioned above — as inflation goes down, rates are also likely to go down, which in turn should make the mortgage applications and sales go up. It may take some time for lower inflation to work its way through the economy to the point where things feel significantly better, but this is very positive news compared to what we’ve been seeing lately.

(Data Sources: U.S. Bureau of Labor Statistics. The Wall Street Journal, HousingWire, DMAR)

INFO FOR SELLERS

Home Prices Are Still Increasing

Late fall and early winter are historically the worst times to sell a home, but many people do it every year. If you do need to move this fall/winter, the odds are that your home would sell at or close to asking price, if priced correctly. Some sellers are afraid to list right now given the current economic conditions, but as a homeowner it’s important to think about the long-term trends. If this is the right time in your life for you to move, consider that average home prices were still up over 8% in October from October of last year. Although things are taking longer to sell right now, at around 28 days on market, the demand for homes is still there, and we are still in a seller’s market.

INFO FOR BUYERS

Now Could Be Your Time to Shine!

Now that rates have gone down a bit, you’ll likely be able to lock in a lower monthly mortgage payment than before. Inventory is also up considerably since more people are waiting on the sidelines. In October there were 116% more homes to choose from than in October ’21. Although many other buyers might have given up due to fear of the economy or rising interest rates, you can still get out there and have a fighting chance of getting the home you want at a lower price than before. Homes are selling at an almost 3% price reduction on average right now. Home builders are also feeling the pinch from the economy, so many are offering buyers concessions right now. Many of them overbuilt, and now with softening demand due to rising rates, they are likely stuck with inventory they cannot sell fast enough. Sitting inventory can be quite expensive for builders, so they’ll likely feel massive pressure by the end of the year to sell those homes and cut their losses. Perfect time for you to swoop in and get a great deal!

*We use reasonable efforts to include accurate and up-to-date information. The real estate market changes often. We make no guarantees of future real estate performance and assume no liability for any errors of omission in the content.

As always, feel free to contact us if you have questions or are interested in making a move.

The post Denver Real Estate News – December 2022 appeared first on New Era Group.