From providing insights into market data, automating daily tasks, and even managing properties and showings, AI is transforming real estate. According to Morgan Stanley research, these AI innovations “could lead to $34 billion in efficiency gains” in the industry by 2030. For agents with forward-thinking business and growth plans, this is great news.

AI assistance can help agents. It cuts costs and boosts productivity in ways that can be truly life-changing. But some may fear that AI is more than a tool to leverage — that it’s competition for agents. They may mistakenly believe AI has the potential to replace agents altogether. But with the integration of AI across multiple industries, one thing remains an inarguable truth: There’s power in a human fiduciary.

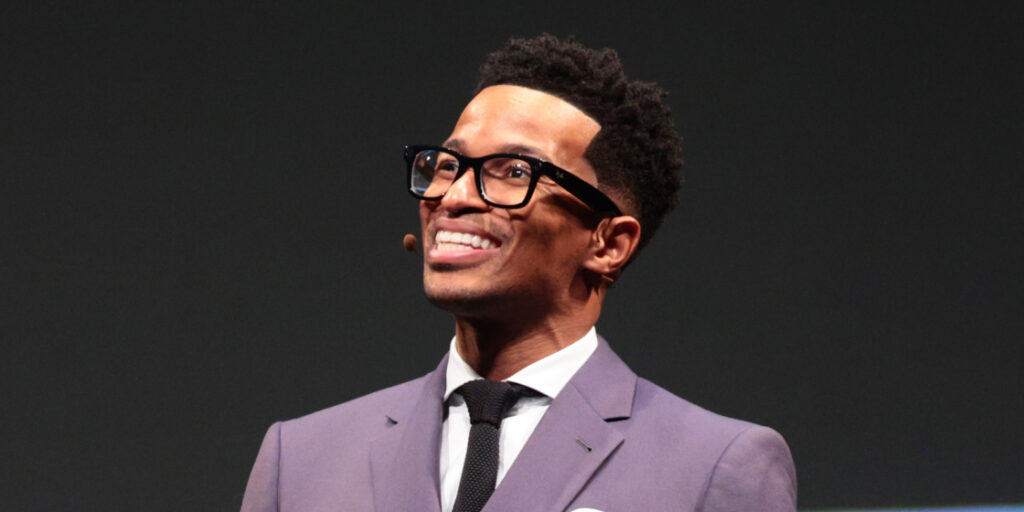

Being a successful real estate agent is about connection and community, and these factors are now more important than ever. In his newest book, Rookie Real Estate Agent: Launch a Limitless Career That Lasts, Jay Papasan shows just how irreplicable a real, live agent is — especially in times of mass digital integration. An agent who is willing to master their skills and become a true fiduciary can future-proof their career in real estate. And Rookie will show you how to do just that.

Human Connection — The Shining Star in a World of AI

While AI offers efficiency and streamlines our systems, human connection is what bridges the gap between getting the job done and creating clients for life.

You can’t force AI to learn emotional intelligence, even though some platforms can demonstrate very human-like tendencies. AI can’t live a similar life to your client, share their interests and values, or hold their hand through the highs and lows of navigating a transaction.